Year-End Tax Preparation and Planning Checklist for Dealerships : Articles : Resources : CLA CliftonLarsonAllen

Contents:

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte Global”) does not provide services to clients.

2022 to 2023 Compliance Audit checklist for schemes delivered … – GOV.UK

2022 to 2023 Compliance Audit checklist for schemes delivered ….

Posted: Tue, 14 Jun 2022 07:00:00 GMT [source]

Review customer accounts receivable to determine which past-due accounts are uncollectible. Remember that uncollectible factory incentives, rebates, and other receivables can also be written off. Make sure to reconcile your parts inventory balances on your books with your parts inventory counter pad. This is normally done if a physical parts inventory is taken, but it does not require a physical inventory. Reconciling the two inventory balances often results in decreased taxable income.

Review the possibility of bunching deductions

This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice. One thing you can do if you want to obtain and retain exposure to a given market sector is to buy a security that provides similar exposure to that market sector. Stock investors certainly have a lot of latitude to stay in a given sector while swapping securities around. To use a simple example, say you are a Wal-Mart holder; you’ve had losses in the stock, but you wanted to retain exposure to that discount-retailing space. Of course, you’d want to be as convinced in the attractiveness of Costco, its valuation, and everything else before making that trade; but you could essentially maintain exposure to that same general market space. The information contained herein does not constitute tax advice, and cannot be used by any person to avoid tax penalties that may be imposed under the Internal Revenue Code.

This also involves keeping track of investment activities from the start of the year to date and taking note of any tax deductions. I’ll talk about fully funding your retirement-plan contributions before year-end. And for people who are subject to required minimum distributions, or RMDs, I’ll talk about some ways that you can use those RMDs to actually improve your portfolio to improve its risk/reward profile. I’ll talk about making charitable gifts, which is relevant to investors of all ages. And finally, I’ll spend a few minutes talking about flexible spending accounts and how you want to try to liquidate those balances if you possibly can before year-end. Since money in an HSA account remains yours and contributions reduce taxable income, maximizing contributions is a smart tax planning move.

Tax-Advantaged Accounts

Up to £1,260, 10% of the personal allowance, can be transferred to the spouse/civil partner where one party to the marriage/civil partnership is a basic rate taxpayer, and the other has income below the personal allowance. The reduction in the tax liability for the basic rate taxpayer is up to £252 in the current year. The income and capital gains generated is tax-free and not taxed when withdrawn. Taxpayers may be able to achieve significant savings with respect to this deduction by deferring income or accelerating deductions to come under the dollar thresholds for 2022.

Everyone eventually has medical expenses, and using pre-tax money to pay for them is almost as good as getting a 20 percent discount. If you own an interest in an S corporation, you may need to increase your tax basis in the entity so you can deduct a current year tax loss against other income. Selling those $13 and $10 lots will net you a tax loss that you can use to offset capital gains.

- Each month, senior leaders of Hancock Whitney’s Asset Management team discuss the latest news and events that impact markets and the economy.

- Tax professionals are closely monitoring Congress to see if a year-end bill can pass that would allow R&D to remain fully deductible.

- There is a minimum level of £4,000 gross, £3,000 net for those with adjusted income in excess of £312,000.

Your a sample profit and loss statement to help your business should evolve and develop with time to enable you to plan for the future. Consider making 2022 charitable donations via qualified charitable distributions from an IRA. Determining if the AMT applies to you is tricky and may require professional tax assistance. Try to squeeze some planned future medical expenses into the current year to maximize your tax savings if your medical expenses for the current year border on the minimum threshold of 7.5% of your adjusted gross income.

https://bookkeeping-reviews.com/ who are 50 or older by the end of the calendar year can make additional “catch-up” contributions of up to $6,500, for a total of $27,000 in 401 contributions in 2022. If you have celebrated, or will celebrate, your 50th birthday in 2022 and haven’t taken advantage of the catch-up contributions, there’s still time to do so before year-end. This communication is provided by Bryn Mawr Trust for informational purposes only. Investing involves the risk of loss and investors should be prepared to bear potential losses. Past performance may not be indicative of future results and may have been impacted by events and economic conditions that will not prevail in the future. No portion of this commentary is to be construed as a solicitation to buy or sell a security or the provision of personalized investment, tax or legal advice.

The question is whether any gift given now that uses up the exemption will be grandfathered if there is a future reduction in the exemption amount. The IRS has issued favorable regulations preventing a claw back provision unless the taxpayer retained a significant amount of control after the transfer. While individuals might be motivated to sell stock during the 2022 taxable year to capture the capital loss and purchase the same stock at a lower cost, the wash-sale rule could apply. The wash-sale rule prohibits selling an investment for a loss and replacing it with the same or a “substantially identical” investment 30 days before or after the sale. If you do have a wash-sale, the loss will be deferred until the replacement investment is sold.

These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

Nicky discusses ways to take advantage of tax planning opportunities in advance of 5 April.

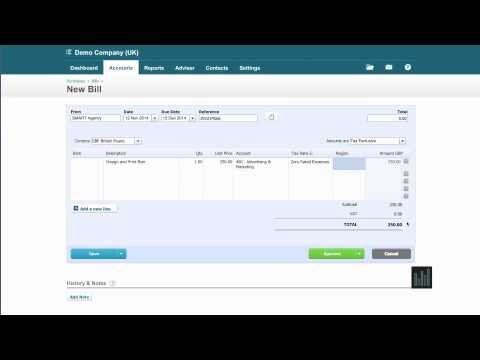

Always keep a backup of your QuickBooks accounts in a record-keeping system in case of a computer crash or any unforeseen event. Providing customized wealth management solutions to individuals and families. For businesses under $5 billion aggregated revenue, the expanded write-off allowance for new business assets has been extended out to fully 100% deductible until 30 June 2023 .

Before we get into the nitty gritty of tax-loss selling, it’s important to remember that this will only be beneficial in your taxable accounts. It typically won’t be a great strategy for IRAs or other account types. So, when it comes to lowering your tax bill, those capital losses can be very, very effective. You can reduce gift and estate taxes by making gifts covered by the annual gift tax exclusion before year-end.

- One way of crystallising capital gains is to sell and then buyback stocks and shares.

- Long-term capital gain from sales of assets held for more than one year is taxed at 0%, 15% or 20%, depending on the taxpayer’s taxable income.

- This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting, tax, or other professional advice.

- With stock market volatility continuing, many investors are looking for alternative strategies.

- This is a tax on interest, dividends, rental income, capital gains, and passive income.

- There are a few ways HSAs can have a positive effect on your taxes.

If you will be in the 12% bracket in 2022 but might be in the 22% bracket in 2023, your deductions will be worth more in 2023. A major tax bracket change might apply if you were, say, unemployed for a chunk of 2022 but then started a new job, among other possible scenarios. If you plan to itemize your deductions, you will need to collect all your backup documents for your eligible expenses incurred throughout the tax year. Pay attention to your annual contribution limits for employer-sponsored retirement accounts such as 401s and 403s. For most employees, the limit is $20,500 for 2022 ($22,500 for 2023). Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

Make sure you are doing all you can to minimize your taxes by taking action soon. You may want to bunch medical expenses into the current year before December 31 if you plan to itemize. Itemized expenses are only deductible to the extent they exceed 7.5% of your adjusted gross income for medical and dental expenses.

This limit is increased to £2 million where investments over £1 million are invested in knowledge-intensive companies. You are building a pension pot to use in your retirement or pass to future generations. Great care needs to be taken to ensure that the gifts are habitual in nature and are out of income which is in excess of regular expenditure. You and your family can take advantage of a number of IHT free reliefs. A bonus of 25% of that year’s contributions is added on each contribution.

Information provided and statements made should not be relied on or interpreted as accounting, financial planning, investment, legal, or tax advice. Hancock Whitney Bank encourages you to consult a professional for advice applicable to your specific situation. Your financial professionals can assist you with year-end tax planning and help you prepare for the new year.

Nicky discusses ways to take advantage of tax planning opportunities in advance of 5 April. 1% Stock Buyback Excise Tax – The IRA included a new provision requiring covered corporations to pay a 1% tax on the fair market value of any corporate stock that is redeemed after December 31, 2022. A covered corporation is a domestic corporation that has stock traded on an established securities market. Based on the current language, the definition of a covered corporation could have an unexpected application to domestic special purpose acquisition companies . Tax professionals have requested additional guidance from the IRS on the intended application of this new law. The estate tax is once again becoming a hot button issue even with the lifetime exemption currently set at $12.06 million per person (and $12.92 million in 2023).

If so, you might want to consider converting a portion of tax-deferred dollars from Traditional IRA to dollars that grow tax-free in a Roth IRA. Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams.

Those have been particularly hard-hit categories over the past year. Before the new year arrives, you have the period from October to December to make the necessary adjustments in preparation for tax season. Establishing a timeline should prompt you to set aside time to fully prepare before the tax period arrives. It also allows you to check and recheck any problematic areas in your record-keeping, as well as review your tax planning strategies. The maximum tax-deferred contribution to a 401 retirement plan increased by $1,000, reaching $20,500 for individuals under age 50 in 2022.

A taxpayer can make an election to deduct a disaster loss in a federally declared disaster area for the year before the year in which the loss occurs is made on an original return or amended return for the preceding year. So, a calendar-year taxpayer who suffers a disaster loss in 2022 has until October 16, 2023 , to file an original or amended 2021 return to deduct the loss for 2021. As we wind down the 2015 tax year, year-end tax planning will be especially challenging.